KEEP YOUR REGISTRATION DETAILS UP TO DATE

*If you meet the conditions of mandatory de-registration, you have to apply to the FTA to de-register as a taxable person

VAT DE-REGISTRATION

You have no longer provided taxable supplies and do not intend to make any supplies in the following 12 months

The value of your taxable supplies or expenses over the past 12-month period is less than the Voluntary Registration Threshold (AED 187,500), and you do not expect to supply taxable supplies or incur taxable expenditure in excess of the Voluntary Registration Threshold in the next 30 days

Deregistration application should be made via the "Deregister" option on the EmaraTax Portal

Deregistration application cannot be completed unless all outstanding liabilities have been settled

KEEP YOUR RECORDS

Tax Registrants Must Keep the Following Records

- Records of all supplies and imports of goods and services

All Tax Invoices, credit notes, and alternative documents issued

Records of goods and services for which Input Tax was not deducted

Records of adjustments or corrections made to accounts or Tax Invoices

Inventory Records

- All Tax Invoices, credit notes, and alternative documents received

Records of goods and services that have been disposed of or used for non-business activities, including VAT amounts paid on such goods and services

Records of exported goods and services

- Payable output tax on taxable supplies

Payable output tax on taxable supplies, calculated using the Reverse Charge Mechanism

Payable output tax after making corrections or adjustments

Recoverable input tax on supplies or imports

Recoverable input tax after corrections or adjustments

Correcting past errors

If it is more than 10K errors:

Suppose the error relates to a tax return or tax

assessment, and the value of the error has resulted in an

underpayment of VAT of AED 10,000 or less. In that case,

you may correct the error in the Tax Return for the Tax

Period in which you discovered the error

If it is less than 10K errors:

Suppose the value of the error has resulted in an

underpayment of VAT of more than AED 10,000.

In that case, you are required to make a Voluntary

Disclosure to the FTA

Balance sheet, Statement of Profit or Loss,

and Other Comprehensive Income

Records of fixed assetsfixed assetsfixed assetsfixed assets

All relevant inventory records and records of inventory checks (including quantities and values) at the end of any Tax Period

Records of salaries and wages

FOR REAL ESTATE OWNERS, THE RECORDS THAT MUST BE KEPT ARE

NON-EXECUTIVE DIRECTORS MUST KEEP THE FOLLOWING RECORDS

PERFORMERS AND SOCIAL MEDIA INFLUENCERS MUST KEEP THE FOLLOWING RECORDS

You may request a VAT refund at any point in time if the input VAT is greater than the output VAT after submitting a VAT return or if there is a credit due to other circumstancesa credit due to other circumstancesa credit due to other circumstancesa credit due to other circumstances

Please keep your bank details up to date for faster refund processing

Once you have submitted a VAT refund application to the FTA, the Authority will inform you of the approval or rejection within 20 working days. In certain cases, the FTA will inform you that it may take longer than usual to process your application for audit purposes

If no VAT Refund is requested, any credit balance will be carried forward to subsequent tax periods and can be offset against future payable tax or administrative penalties imposed

SUBMIT YOUR TAX RETURNS ON TIME

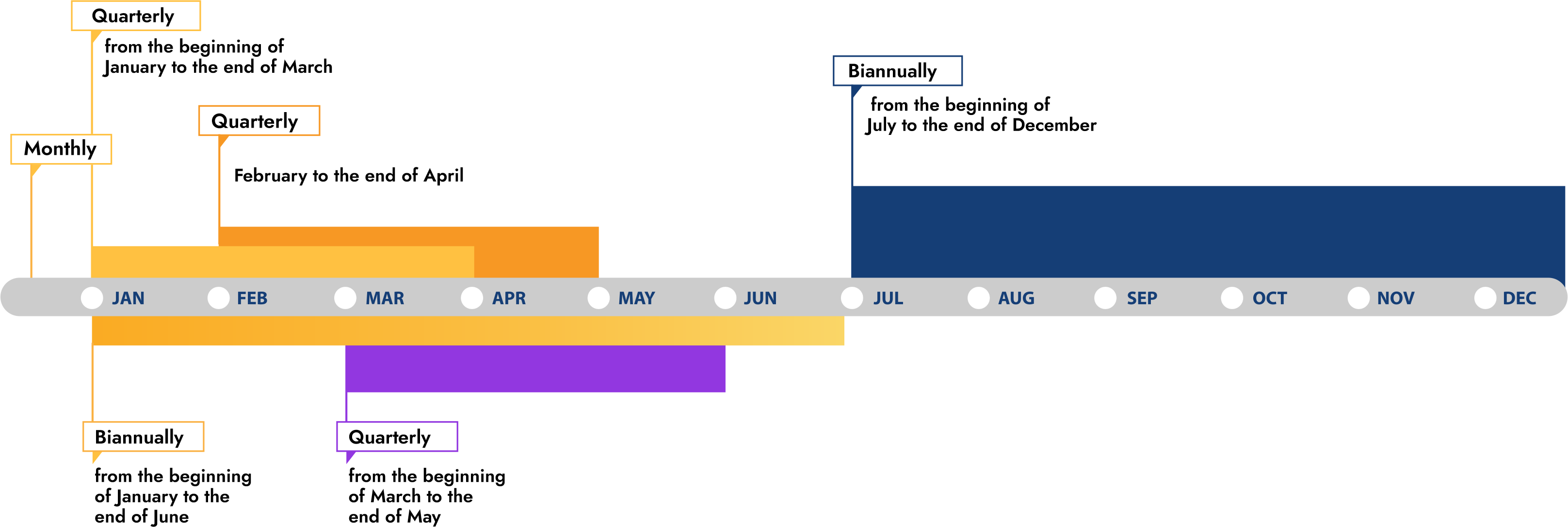

Examples of Tax periods (“Staggers”)

- Name, address, and TRN (auto populated on the system)

Tax Period to which the Tax Return relates

Date of submission

Value of Taxable Supplies made in the Tax Period and the Output Tax charged

Value of Taxable Supplies subject to the zero rate made in the Tax Period

Value of Exempt Supplies made in the Tax Period

Value of any supplies subject to the Reverse Charge Mechanism

Value of expenses incurred in respect of you would like to recover input tax

Input Tax and the amount of Recoverable Tax

Total value of Due Tax and Recoverable Tax for the Tax Period

Payable Tax for the Tax Period 20

SETTLE YOUR PAYABLE TAX ON TIME

ISSUE VALID TAX INVOICES FOR ALL TAXABLE GOODS & SERVICES PROVIDED OR SOLD

ISSUE VALID TAX INVOICES FOR ALL TAXABLE GOODS & SERVICES PROVIDED OR SOLD

- If the recipient demands the tax calculation, the invoice must contain said details, as per Article 48 of the Law

- Ensure that the prices of goods and services advertised to consumers include VAT, whether in food menus, catalogues, or price tags

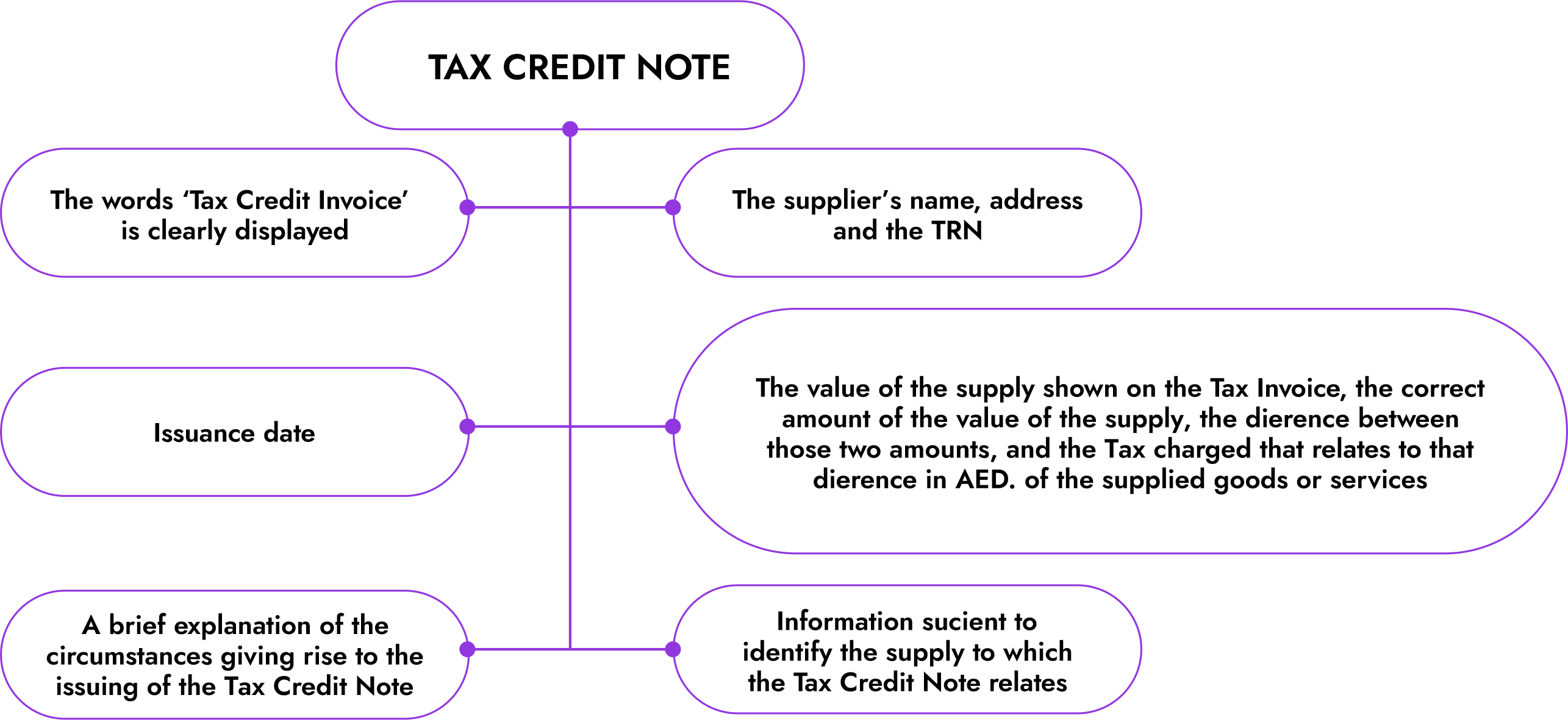

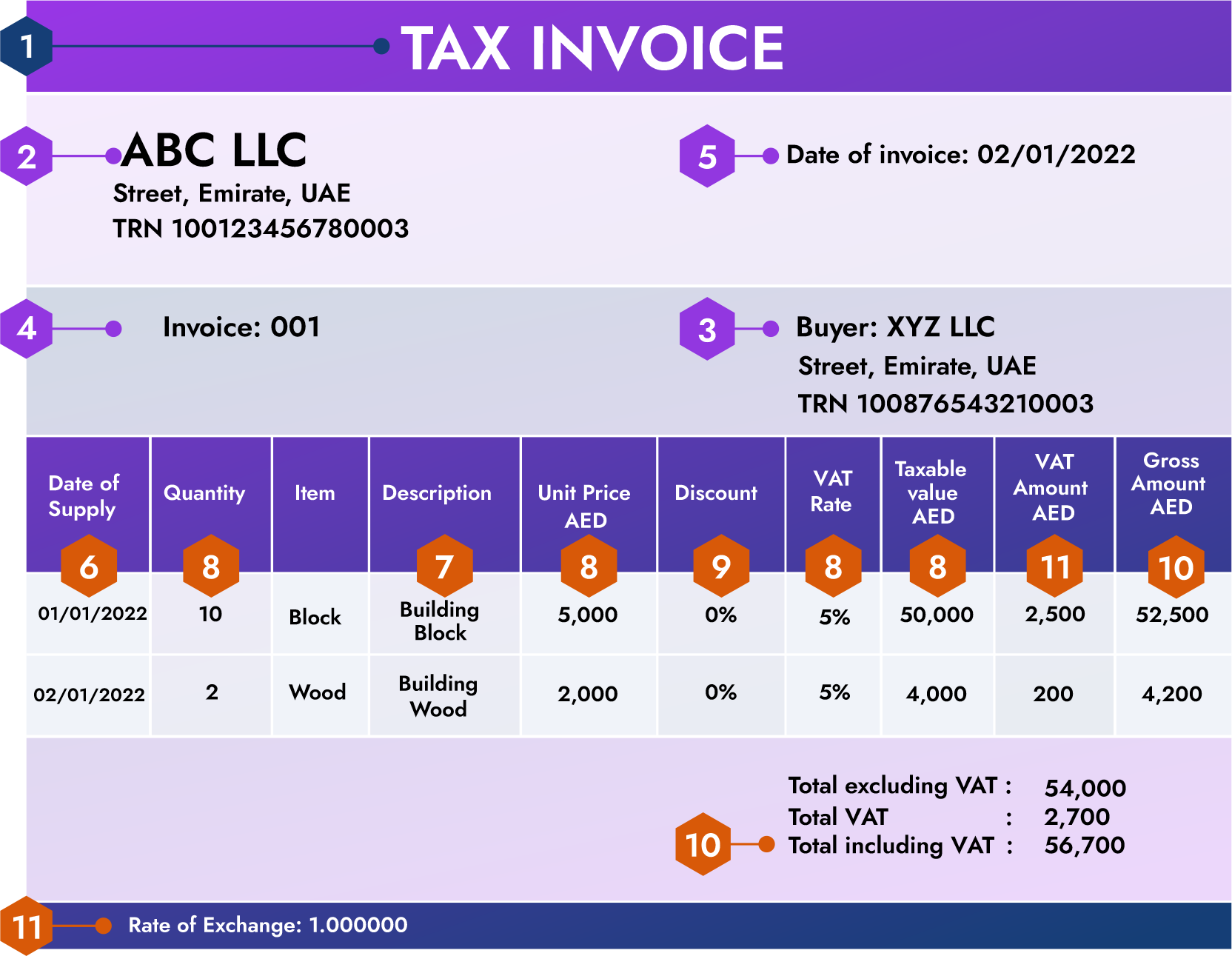

01 The words ‘Tax Invoice’ is clearly displayed on the invoice

02 The supplier’s name, address and the Tax Registration Number (TRN)

03 The receiver’s name, address, and TRN (if registered)

04 The serial or relevant Tax Identification Number (TIN) that helps

identify the Tax Invoice and its number in any number of invoices

05 Issuance date

06 Supply date, if it is different from the issuance date

07 Details of the supplied goods or services

08 The unit price, quantity or size of supplies, payable VAT rate and payable amount (in AED) for each good or service

09 Any offered discount rates

10 Total payable sum in AED

11 Payable tax in AED with the applicable exchange rate

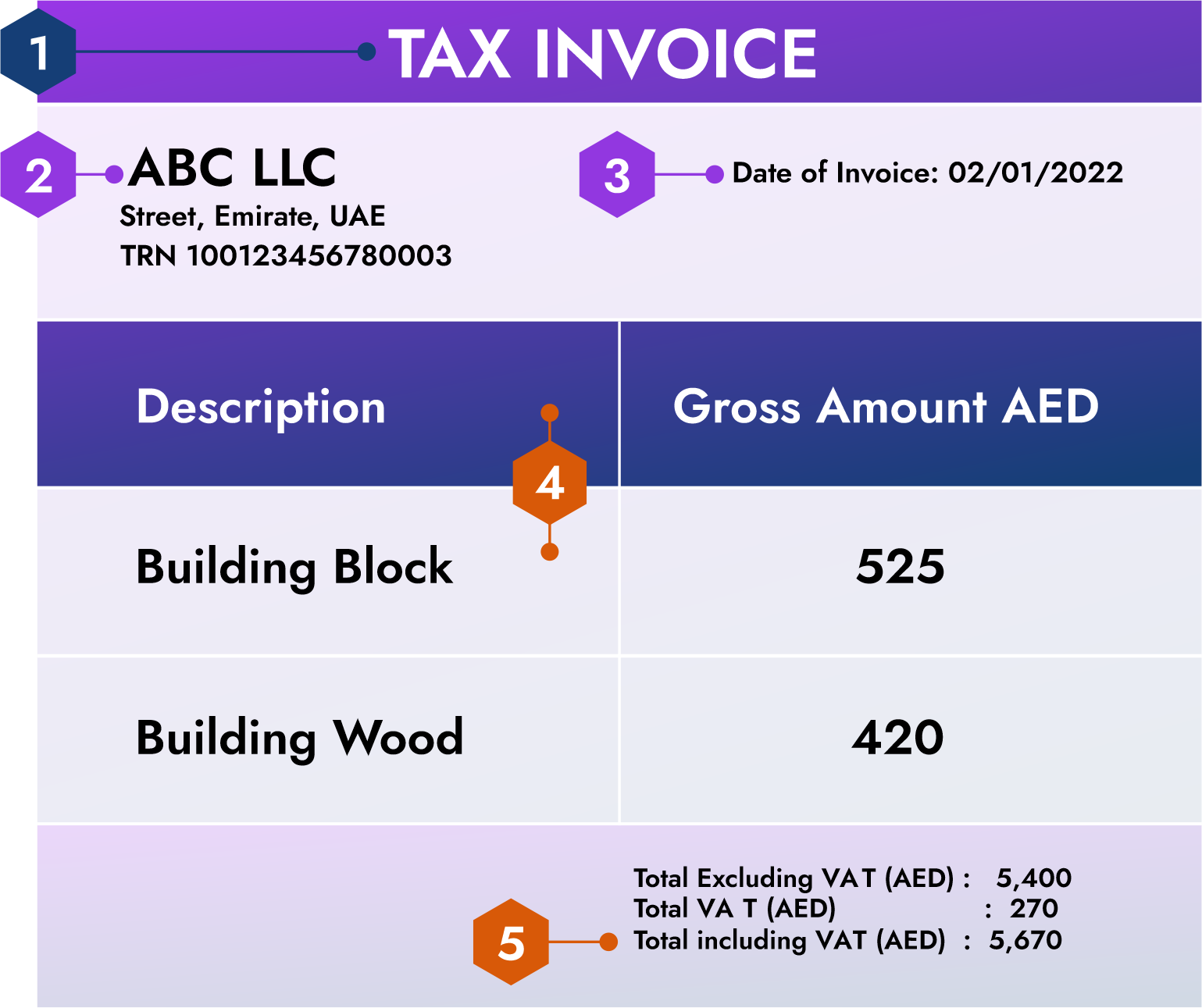

Simplified Tax Invoice

A SIMPLIFIED TAX INVOICE MUST INCLUDE

01 The words ‘Tax Invoice’ in clear writing

02The supplier’s name, address, and TRN

03 Tax Invoice issuance date

04 Details of the supplied goods or services

05 The total consideration and tax charged

YOU MAY ISSUE SIMPLIFIED TAX INVOICES IN ANY OF THE FOLLOWING CASES

- If the recipient is not registered for VAT

- If the recipient is registered for VAT and the supply does not exceed AED10,000

ISSUE VALID TAX CREDIT NOTES TO CORRECT OUTPUT TAX ERRONEOUSLY CHARGED